Aranjin Resources Ltd. (TSXV: ARJN) ("Aranjin" or the "Company") announces that it has closed its previously announced non-brokered private placement, raising total gross proceeds of $230,400 through the issuance of 2,880,000 units (each, a "Unit"), at a price of $0.08 per Unit (the "Offering"). Each Unit consists of one common share of the Company and one common share purchase warrant. Each warrant entitles the holder to purchase one common share of the Company at a price of $0.105 at any time on or before that date which is twenty-four months after issuance.

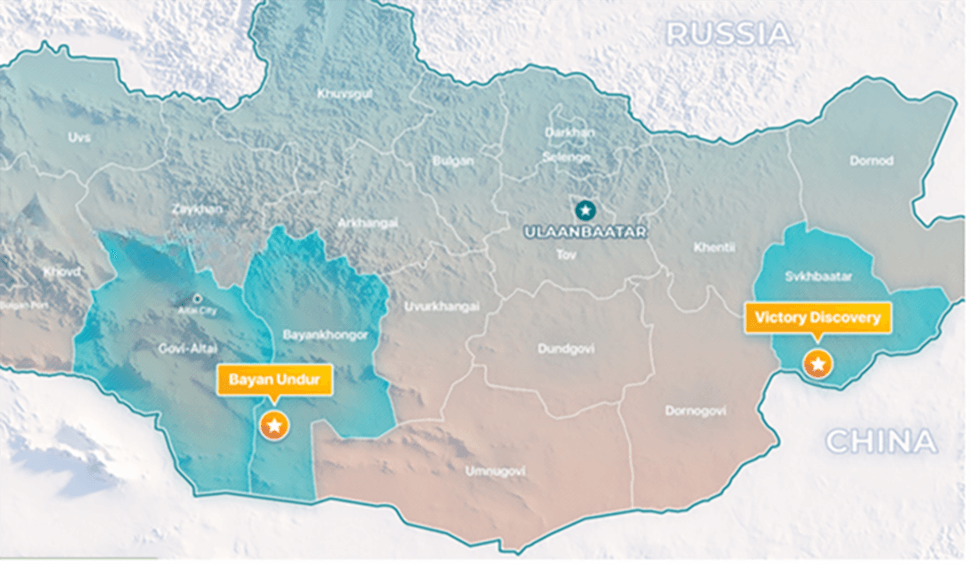

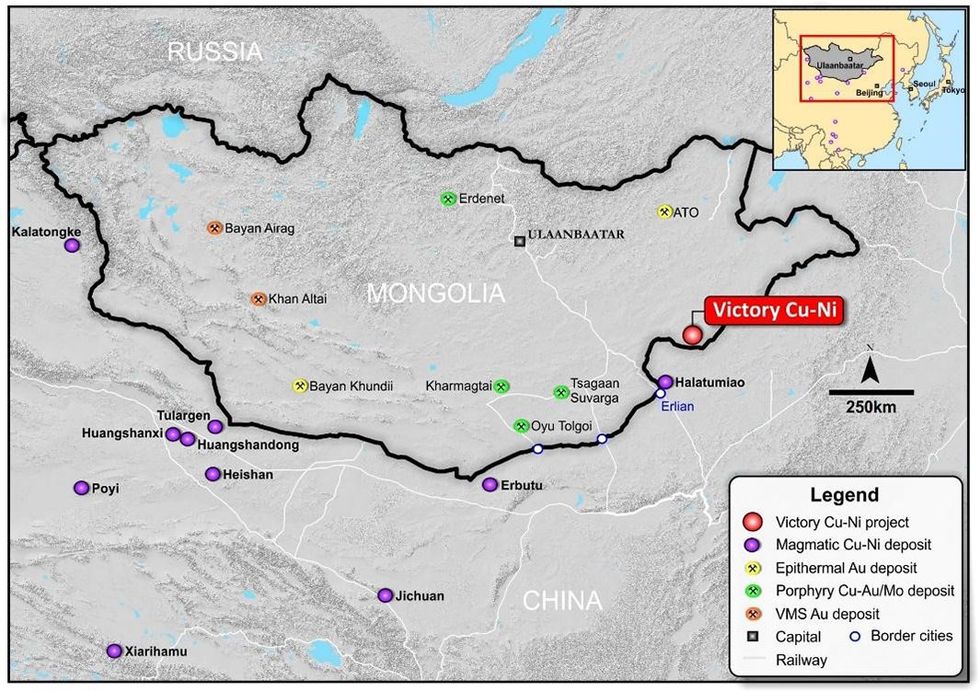

The Company intends to use the net proceeds received from the sale of the Units to maintain the Company's Projects in South Australia and Mongolia and for general working capital. The Company did not pay any finders' fees in relation to the Offering.

The Company further announces that it has closed its previously announced debt settlements with certain arm's length and non-arm's length creditors (the "Debt Settlement"). Pursuant to the Debt Settlement, the Company has settled an aggregate amount of $349,423 in debt in consideration for which it issued an aggregate of 4,367,788 common shares of the Company at a deemed price of $0.08 per share. In relation to the Debt Settlement, the Company also issued 1,891,538 warrants. Each warrant entitles the holder to purchase one common share of the Company at a price of $0.105 at any time on or before that date which is twenty-four months after the date of issuance.

All securities issued and sold under the Offering and issued in relation to the Debt Settlement are subject to a hold period expiring four months and one day after the date of issuance in accordance with applicable securities laws and the policies of the TSX Venture Exchange (the "TSXV"). The Offering and Debt Settlement remain subject to the final approval of the TSXV.

Related Party Transaction

In connection with the Debt Settlement, certain insiders of the Company were issued an aggregate of 2,641,538 shares and 1,891,538 warrants. The acquisition of the shares and warrants by insiders in connection with the Debt Settlement is considered a "related party transaction" pursuant to Multilateral Instrument 61-101- Protection of Minority Security Holders in Special Transactions ("MI 61-101") requiring the Company, in the absence of exemptions, to obtain a formal valuation for, and minority shareholder approval of, the "related party transaction". The Company is relying on an exemption from the formal valuation requirements of MI 61-101 available because no securities of the Company are listed on specified markets, including the TSX, the New York Stock Exchange, the American Stock Exchange, the NASDAQ or any stock exchange outside of Canada and the United States other than the Alternative Investment Market of the London Stock Exchange or the PLUS markets operated by PLUS Markets Group plc. The Company is also relying on the exemption from minority shareholder approval requirements set out in MI 61-101 as the fair market value of the participation in the Debt Settlement by the insiders does not exceed 25% of the market capitalization of the Company, as determined in accordance with MI 61-101. The Company did not file a material change report in respect of the related party transaction at least 21 days before the closing of the Debt Settlement as the Company wished to close the Debt Settlement in an expeditious manner.

Early Warning Disclosure

Pursuant to the Offering, on April 9, 2025, Tsagaachin Bayan Nuur LLC ("TBN") of Bella Vista 400-1801, Khan Uul District 11,Ulaanbaatar,Mongolia, acquired 2,880,000 Units at a price of $0.08 per Unit for total consideration of $230,400. Each Unit consists of one common share and one warrant, with each warrant exercisable into an additional common share of the Company at $0.105 per share for 24 months from the date of issuance. Prior to the Offering and Debt Settlement, TBN held 80,300 common shares, or approximately 0.73% of the Company's issued and outstanding shares.

The warrants issued to TBN in the Offering contain a provision that the entity is not able to exercise such number of the warrants as would result in TBN holding more than 19.99% of the issued and outstanding shares of the Company, without first obtaining disinterested shareholder approval, as required by the policies of the TSXV.

Following the Offering and the Debt Settlement, TBN holds 2,960,300 common shares and 2,880,000 warrants, representing approximately 16.17% of the Company's then issued and outstanding shares, on an undiluted basis, or approximately 27.56% of the Company's then issued and outstanding shares, on a partially diluted basis, subject, however, to TBN being precluded from exercising warrants that would result in TBN holding more than 19.99% of the issued and outstanding shares of the Company, without the Company first obtaining disinterested shareholder approval.

Pursuant to the Debt Settlement, on April 9, 2025, Matthew Wood, a director of the Company, through Mongolia Wealth Management Pty Ltd. ("Mongolia Wealth") of 536 Glover Road, Manapouri Queensland, Australia, 4361, acquired 1,891,538 common shares, at a deemed price of $0.08 per share, and 1,891,538 warrants of the Company, in settlement of $141,323 bona-fide debt. Each warrant is exercisable into one additional common share at a price of $0.105 per share for a period of 24 months from the date of issuance. Prior to the Debt Settlement and the Offering, Mr. Wood held, directly and indirectly, 514,832 common shares and 250,000 warrants of the Company, representing approximately 4.65% of the Company's issued and outstanding shares on an undiluted basis, or approximately 6.76% of the Company's issued and outstanding shares, on a partially diluted basis.

The warrants issued to Mongolia Wealth in the Debt Settlement contain a provision that the entity is not able to exercise such number of the warrants as would result in Mr. Wood holding more than 19.99% of the issued and outstanding shares of the Company, without first obtaining disinterested shareholder approval and TSXV approval, as required by the policies of the TSXV.

As a result of the Debt Settlement, Mr. Wood holds, directly and indirectly, 2,406,370 common shares of the Company and 2,141,538 share purchase warrants, representing approximately 13.14% of the Company's then issued and outstanding shares, following the Debt Settlement and the Offering, on an undiluted basis, or approximately 22.23% of the Company's then issued and outstanding shares on a partially-diluted basis, subject, however, to Mongolia Wealth being precluded from exercising warrants that would result in Mr. Wood holding more than 19.99% of the issued and outstanding shares of the Company, without the Company first obtaining disinterested shareholder approval and TSXV approval.

Mr. Wood and TBN acquired the securities of the Company for investment purposes, and either may, depending on market and other conditions, increase or decrease their beneficial ownership of the Company's securities, whether in the open market, by privately negotiated agreements or otherwise, subject to a number of factors, including general market conditions and other available investment and business opportunities. The disclosure respecting Mr. Wood and TBN's security holdings contained in this news release is made pursuant to National Instrument 62-103 - The Early Warning System and Related Take-Over Bid and Insider Reporting Issues and National Instrument 62-104 - Take-Over Bids and Issuer Bids, and an early warning report respecting each of the above acquisitions will be filed with the applicable securities regulatory authorities and will be available for viewing under the Company's profile on the SEDAR+ website at www.sedarplus.ca.

This news release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities in the United States of America. The securities have not been and will not be registered under the United States Securities Act of 1933 (the "1933 Act") or any state securities laws and may not be offered or sold within the United States or to U.S. Persons (as defined in the 1933 Act) unless registered under the 1933 Act and applicable state securities laws, or an exemption from such registration is available.

On behalf of the Board

Matthew Wood

Chairman

contact@aranjinresources.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Forward-looking Statements

Certain information contained herein constitutes "forward-looking information" under Canadian securities legislation. Forward-looking information includes, but is not limited to, the completion of the Offering and Debt Settlement on the terms and timing described herein, the Offering and Debt Settlement, the Company's proposed use of proceeds from the Offering, receipt of TSXV approval for the Offering and the Debt Settlement, , the Company's reliance on certain exemptions from requirements under MI 61-101, the Company filing a material change report and the timing thereof,. Generally, forward-looking information can be identified by the use of forward-looking terminology such as "will", "anticipates" or variations of such words and phrases or statements that certain actions, events or results "will" occur. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made and they are from those expressed or implied by such forward-looking statements or forward-looking information subject to known and unknown risks, uncertainties and other factors that may cause the actual results to be materially different, including receipt of all necessary regulatory approvals. Although management of the Company have attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward-looking information. The Company will not update any forward-looking statements or forward-looking information that are incorporated by reference herein, except as required by applicable securities laws.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/247890